President Joe Biden announced a three-part student debt forgiveness plan on Aug. 24. The program will cancel up to $20,000 in student loans for graduates who identify as low-to-middle-class borrowers. The federal government will start to forgive loans when individuals complete an application that will be accessible in early October. Undergraduate students, graduate students, and alums are all eligible for the program and will have until December 31, 2023, to get their applications in.

In 2007, President Bush signed the College Cost Reduction and Access Act that rolled out a ‘Public Service Loan Forgiveness” and a “Teacher Loan Forgiveness” program that forgave portions of student loans for government officials, teachers and qualifying public service professionals. The Biden administration’s new program will provide relief for a broader range of individuals.

A university representative told The Hustler that Vanderbilt aims for its students to be able to attend college without having to take out loans. In 2009, the university announced ‘Opportunity Vanderbilt,’ a need-based scholarship that works to cover 100% of a student’s demonstrated need, according to the Office Of Financial Aid. Opportunity Vanderbilt is responsible for replacing loans with scholarships and grants.

The Office of Financial Aid encouraged students to continue checking the Federal Student Aid website for information regarding the loan cancellation announcement.

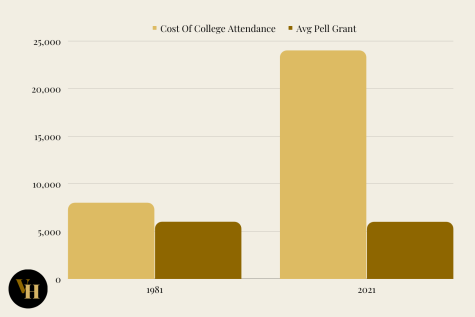

According to CollegeBoard, the cost of attending college has risen since the 1980s, from an average of $8,000 annually in 1981 to nearly $24,000 in 2021. However, the amount of money students receive from the federal Pell Grant has moderately stayed mostly the same.

(Alexa White)

Fifth-year biomedical Ph.D. candidate Sirena Tran said she is happy with the decision and the opportunities it will provide for lower-income students.

“I’m glad that something is being done about student loans beyond the loan forgiveness program that they used to have because I felt like a lot of people could not meet that criteria,” Tran said, “I was hoping during his administration that he’d do something about this, since this is really what he campaigned about, and I kinda felt like for a long time, that it was all words.”

Tran said she feels sorry for those who already paid off their student loans and are now unable to have their loans forgiven.

“I think that’s very unfortunate, and I understand where they are coming from because I would’ve gotten very upset that they are not helping everybody,” Tran said.

First-year Delano Herkert took out unsubsidized and subsidized loans to attend Vanderbilt and said that even though the change benefits him, he is skeptical about the decision’s economic impacts.

“I hope that it benefits me, that’ll be great, but at the same time this is going to be a complete disaster for the economy and there’s going to be so much government money coming out that there is going to be an even bigger surge of inflation,” Herkert said.

In a press address from the White House, Biden disagrees with the outrage from many critics of the bill, comparing the reactions of business loans to student loans.

“ Just as we never apologized when the federal government forgave almost every single cent of over $700 billion in loans to over several hundred thousand of small businesses,” Biden said. “ No one complained that those loans caused inflation. So the outrage over helping working people with student loans is simply wrong, dead wrong.”

How to qualify for loan forgiveness

To qualify for the debt forgiveness plan, students must apply to the application available in October and earn less than $125,000 a year as an individual. According to Forbes Advisor, it is unclear if another round of mass debt forgiveness will happen. Forbes continues by emphasizing that this is unlikely to happen again. If this is a one-time problem, then students in the future will have to rely on loans to get them through the newly raised tuition rates.

Federal loans will qualify for forgiveness under the new plan, but private loans will not. Individuals who have received Pell Grants in college and meet the income requirements are eligible for up to $20,000 in debt forgiveness. If a student did not receive a Pell Grant, they could still receive up to $10,000 in debt forgiveness. However, if students have paid a substantial amount of debt and the amount given by the federal government exceeds their current loan bill. According to FAFSA, the money that will run over will not be given to the borrower for personal use.

Vanderbilt undergraduate alum Mike Chaplain (‘01) graduated with over $50,000 in student loans and said he was disappointed that he had already paid off his loans and could not take advantage of the program.

“I also got some merit-based scholarships, but there was still some considerable money that needed to be paid off,” Chaplain said.

Some students said they were impacted by recent inflation, making the loan forgiveness program more impactful. Tran noted that her biomedical P.h.D program had expanded its stipend to help its graduate student workers navigate inflation, but having loans makes everything harder to afford.

“They raised our stipend by $1,500 to compensate for the inflation, which I appreciate that they did that, but it’s not at the living wage for Nashville itself,” Tran said. “The things I start cutting when money gets tight are doing fun on the weekend. Sometimes, I just stay home and entertain myself with my things. I used to go to the Nashville markets, but now I can’t do that anymore because of the loans and inflation.”